jersey city property tax phone number

This program will allow residents to enroll with the Tax Collector and permit Automatic Debit transactions from a bill payers designated checking or savings account whenever a tax. For more information please contact the Assessment Office at 609-989-3083.

City Of Jersey City Official Government Page

Online Inquiry Payment.

. Left click on Records Search. Revenue Jersey tax Phone number 01534 440300 Email address jerseytaxgovje Opening hours Monday to Friday 830am to 5pm. Please enter the correct routing number and checking account number when processing your payment.

Property Tax Relief Programs. When contacting City of Jersey City about your property taxes make sure that you are contacting the correct office. Department of Revenue Finance.

NJ Division of Taxation PO Box 900 Trenton NJ 08646-0900. Affordable Housing 201 547-5169 9am - 5pm Mon - Fri Holloway Building. A 35 returned check fee will be.

1-800-882-6597 within NJ NY PA DE and MD Office hours are. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON. Jersey City NJ 07302.

11 rows City of Jersey City. This office is responsible for the billing collection and enforcement of all city taxes including real estate. The Jersey City tax collector phone number is 973-621-8453.

Jersey City NJ 07302. In addition bank account information for wire transfer payments will be shown on the 121000358 04743 00743 Form Factor of 5. The main function of the Tax Assessors Office is the appraisal and evaluation of all land and buildings within the municipality for tax purposes according to state statutes.

Contact Us admin 2019-10-17T204043-0400. City of Jersey City. Department of Revenue Finance.

NJ Division of Taxation PO Box 900 Trenton NJ 08646-0900. Online Inquiry Payment. De 051000017 pdf 322271627 tax id pdf 2021.

Under Tax Records Search select. A-Z of States of Jersey departmental contacts. NJ Division of Taxation PO Box 900 Trenton NJ 08646-0900.

TO VIEW PROPERTY TAX ASSESSMENTS. Division of Taxations Property Tax Relief Program. 201 209-6755 Phone 201 459-9173 Fax 830 to 430.

For your convenience property tax forms are available online at our Virtual Property Tax Form Center. Account Number Block Lot Qualifier Property Location 18 14502 00011 20. Automated Phone Numbers.

Property Taxes Payroll Tax Parking Permits Zoning Construction Code. Department of Health and Senior Services.

Jersey City Authorizes Reverse Increase Cases Against Commercial Property Owners Call The Jersey City Nj Property Tax Appeal Attorney Skoloff Wolfe

Jersey City To Refund Property Owners For Arts Tax Overcharge Jersey City Nj Patch

499 Martin Luther King Dr Jersey City Nj 07304 Realtor Com

New Jersey Property Tax Grace Period Moves To June 1

Property Tax Hike Likely Coming To Roughly One Third Of Jersey City Pix11

Jersey City Mails Property Tax Bills Again This Time With Mayor S Message On Tax Hike Don T Blame Me

201 Culver Ave Jersey City Nj 07305 Mls 220009823 Howard Hanna

Jersey City Residents Approve New Property Tax To Fund Arts

Tax Finance Dept Sparta Township New Jersey

Jersey City New Jersey Wikipedia

Jersey City Property Tax Appeals A Civic Step By Step Overview Civic Parent

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Jersey City Unfairly Burdens Small Homeowners With Property Tax Burden Opinion Nj Com

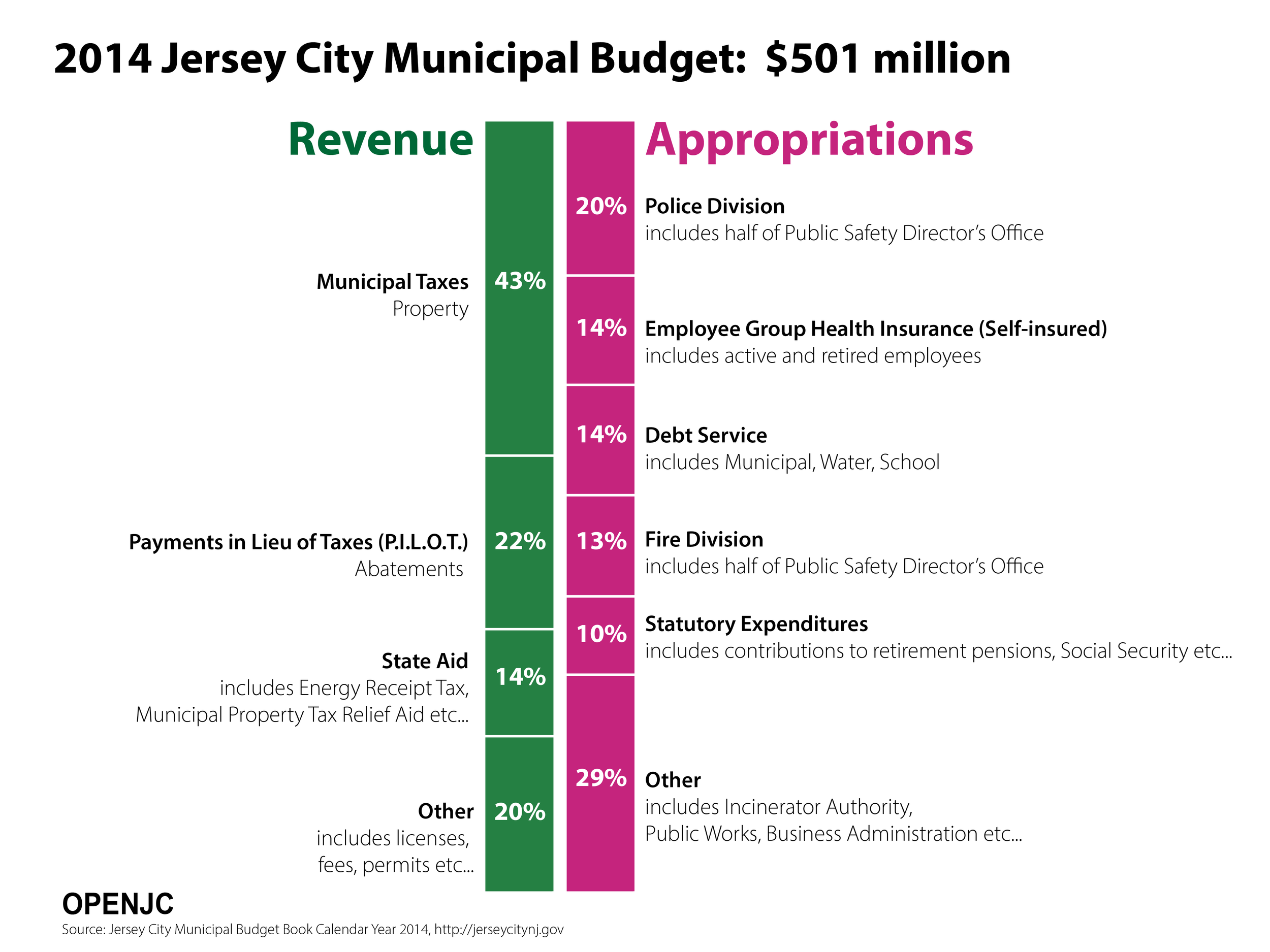

Jersey City 2014 Budget In 4 Easy Graphs Visualizing Economics

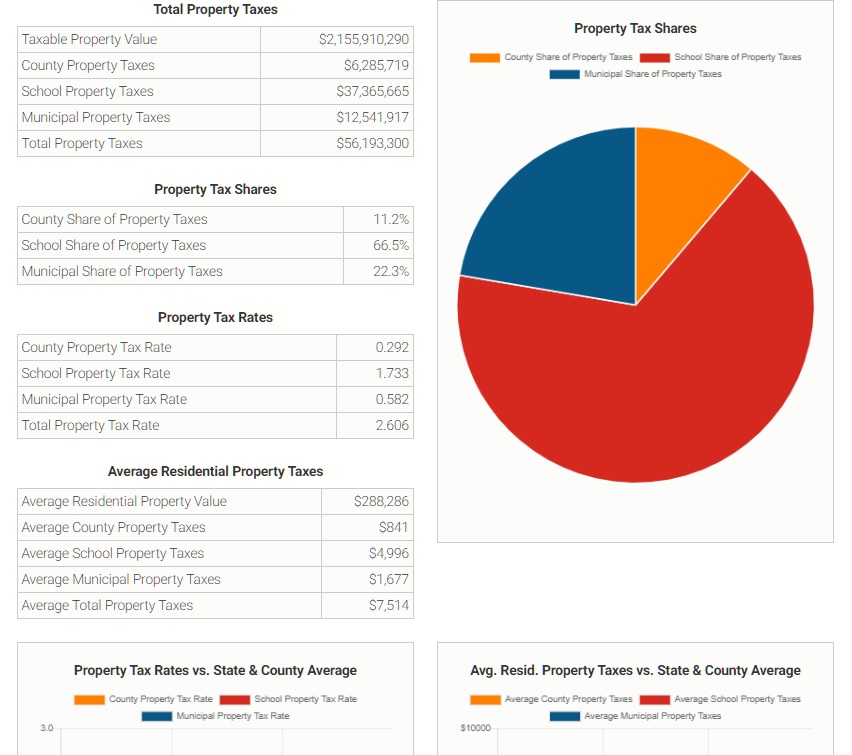

Fair Property Taxes For All Nj Launches New Property Tax Viewer Insider Nj

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs